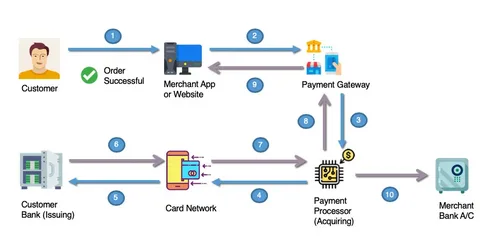

Payment gateways provide for the safe sending of transaction information to banks while facilitating money transactions between clients and merchants. By encrypting it, payment gateways protect the transfer of customer data from the client to the retailer to the processor. Payments are made as a result of internet transactions. Due to the increase in online transactions, businesses are using payment gateways more and more. Payment systems allow customers to check out more quickly and easily while reducing fraud. Another benefit of using payment gateway services is that they eliminate the need for expensive merchant service fees, resulting in lower costs. There are risks attached, though. You can safeguard your company from fraudulent transactions and increase customer satisfaction and trust by implementing Acuitytec risk management. By providing your customers with a secure method of payment without having to worry about their credit cards becoming lost, payment gateways also help to lower theft.

What Is Payment Gateway?

A payment gateway is a service that helps businesses accept payments from their customers. It allows businesses to process credit and debit card payments, as well as online payments. The payment gateway also provides security features, such as fraud prevention and billing management. These features make it easier for businesses to manage their finances and keep track of their customers’ spending. It helps companies to process payments quickly and easily. It connects businesses with banks, credit card companies, and other payment processors. It also provides security for the data that is transmitted between the business and the payment processor.

It is a technology that allows online businesses to accept payments from customers. It works by handling the entire payment process, from receiving the payment to issuing the refund. This saves businesses time and money, as they no longer need to deal with processing payments or refunds themselves. A payment gateway also allows businesses to collect payment information from customers automatically, which can be useful for marketing purposes. . Payment Gateway allows merchants to take payments from customers through their websites and apps. The merchant doesn’t have to deal with the actual transaction; Payment Gateway handles all the technical details for them. This saves the merchant time and money, as they don’t have to set up a payment system from scratch or pay expensive fees for an existing one.

How can a payment gateway secure online transactions?

Payment gateways are important for ensuring that online transactions are safe and secure. In order to protect your customers’ data, payment gateways use security measures such as encryption and authentication. They also have policies in place that prevent fraudulent activities such as account takeovers. They are responsible for verifying the identities of the users and ensuring that the funds are transferred to the right account. Since these gateways handle a lot of sensitive information, it is essential that they are secure. There are a number of ways in which payment gateway can secure their data. Some gateways use SSL (Secure Socket Layer) to encrypt the data. Others use 2-factor authentication to ensure that only authorized individuals can access the system.

It provides a secure platform for customers to make purchases and allows businesses to accept payments from customers around the world. Ideally, a payment gateway should protect the privacy of customer data and ensure that all transactions are processed securely. By using features such as SSL encryption, authentication, and fraud prevention, a payment gateway can ensure that your online transactions are safe and secure.

Payments can be made through traditional payment methods, such as credit cards, debit cards, and bank accounts. Using these systems, the money is directly transferred to the merchant’s bank account after the payment has been processed. This enables businesses to prevent chargebacks, which are fraudulent transactions that a cardholder files against a business. By guaranteeing that only authorized clients can make purchases, payment gateways also assist in lowering fraud.

How can you improve the stability of your online system?

The legitimacy of the payment is determined by authorization and processing. Never authorize a purchase order without first confirming its validity. Vendors could overcharge for orders that are valid. Make sure the vendor has a solid reputation and can offer evidence that the order is valid if you decide to purchase from them. The frequency of cyberattacks is increasing as technology develops. Whether they are major organizations or small businesses, hackers attempt to breach security and steal vital customer information. To keep clients’ trust, internet firms must make sure their payment method is encrypted and safe. Through payment risk management, fraudulent online payments can be decreased. Accepting payments online has gotten harder as the amount of online purchasing has increased. You may safeguard your company from financial theft and online crime by implementing a Secure Payment Gateway solution.